All Categories

Featured

Table of Contents

That frees up money in the short-term, and you might have three to 4 years to conserve towards the settlement amount. Extremely dangerous to credit rating, largely due to missed payments and a negative "cleared up" mark that could remain on your credit report for up to 7 yearsMay be only alternative if other choices (debt combination, balance transfer charge card, financial obligation mercy) aren't possibleTypically calls for a charge to the 3rd celebration, which can offset some or every one of the cost savings from financial debt settlementMay help you stay clear of insolvency if you've missed a number of paymentsNot all creditors function with financial obligation settlement companies Debt forgiveness might be appropriate for you if you are experiencing an economic challenge that makes it nearly impossible to pay for your financial debt balances.

With a DMP, you make one month-to-month repayment to the credit counseling company. Those funds are then distributed to creditors of your unsafe financial debts, such as charge card and installment loans. The company collaborates with your lenders to lower rate of interest or waive fees, however some financial institutions might decline such concessions.

A financial obligation combination lending combines your eligible financial debts right into one brand-new loan. It can assist you pay down financial obligation if you're able to protect a loan price that's reduced than the ordinary price of the accounts you're consolidating. You must abstain from racking up debt on those freshly removed accounts or your financial obligation can grow even greater.

That offers you lots of time to remove or considerably minimize your equilibrium while making interest-free settlements.

Rebuilding Personal Credit Score Post Bankruptcy for Beginners

You may require it if your lender or a collection company ever before attempts to gather on the financial debt in the future. When a lender forgives $600 or more, they are called for to send you Type 1099-C.

Financial obligation mercy or settlement generally harms your credit scores. Anytime you resolve a financial obligation for much less than you owe, it might look like "settled" on your credit rating report and impact your debt rating for seven years from the date of negotiation. Your credit scores can also go down significantly in the months bring about the forgiveness if you fall behind on settlements.

Rumored Buzz on How to Connect With Can You Remove Collections from Your Credit Report Without Paying? : APFSC Experts Today

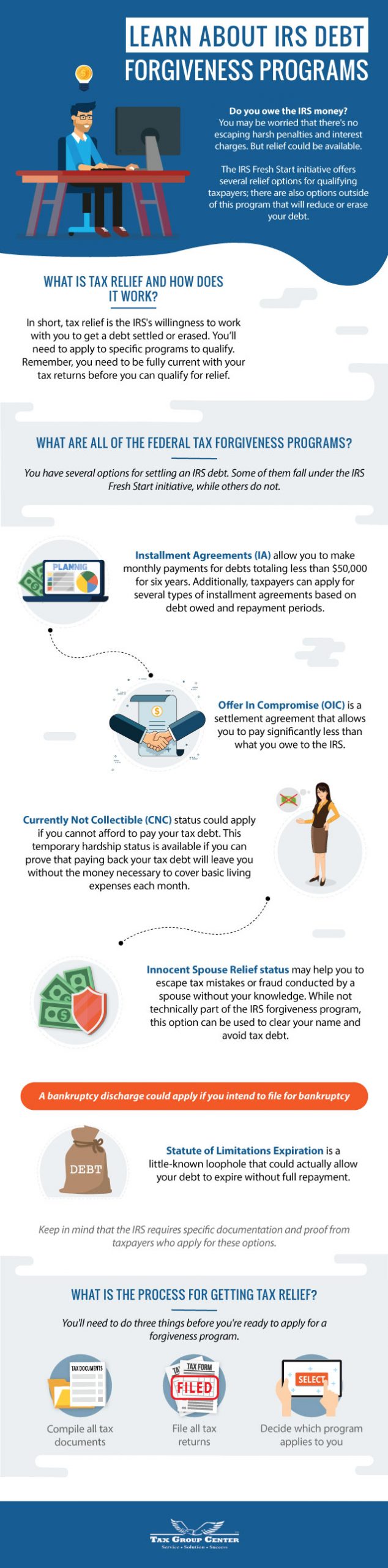

This situation often results from underreporting revenue, not filing returns on time, or discrepancies discovered throughout an IRS audit. The repercussions of collecting tax obligation financial obligation are serious and can include tax obligation liens, which provide the IRS a legal case to your property as safety for the debt.

Higher interest prices on readily available credit scores. Salaries and Bank Accounts IRS can impose (confiscate) earnings and bank accounts to satisfy the financial obligation. Reduced revenue and interruption of important economic processes. Property Seizure In severe cases, the internal revenue service can take and market home to cover the financial debt. Loss of useful assets and possible displacement.

Social Stigma Facing lawful action from the IRS can bring social preconception. Employment Opportunities A bad credit history score due to strain debt can restrict employment opportunities. Government Benefits Tax obligation financial obligation might impact eligibility for federal government benefits, such as Social Safety And Security and Medicaid.

6 Simple Techniques For Categories of Debt Forgiveness You Should Know About

The OIC considers a number of factors, including the taxpayer's earnings, expenses, asset equity, and ability to pay. Efficiently discussing an OIC can be intricate, requiring a comprehensive understanding of the internal revenue service's standards and a strong disagreement for why your offer aligns with your capacity to pay. It is essential to keep in mind that not all applications are approved, and the procedure requires comprehensive financial disclosure.

The internal revenue service analyzes your total financial situation, including your earnings, expenditures, possession equity, and capability to pay. You have to also be existing with all filing and settlement needs and not remain in an open bankruptcy proceeding. The internal revenue service also considers your conformity background, assessing whether you have a document of timely declaring and paying tax obligations in previous years.

The Definitive Guide for Worth to Invest in Professional Debt Counseling

The application procedure for an Offer in Concession involves numerous thorough actions. You must complete and submit IRS Kind 656, the Offer in Compromise application, and Kind 433-A (OIC), a collection details statement for individuals. These types call for extensive monetary info, including information concerning your earnings, financial debts, expenditures, and possessions.

Back taxes, which are unsettled tax obligations from previous years, can considerably raise your overall IRS debt otherwise attended to without delay. This financial obligation can accrue interest and late payment fines, making the original quantity owed a lot larger gradually. Failure to repay taxes can lead to the internal revenue service taking enforcement activities, such as releasing a tax lien or levy against your residential or commercial property.

It is necessary to resolve back tax obligations immediately, either by paying the total owed or by preparing a layaway plan with the internal revenue service. By taking aggressive actions, you can prevent the build-up of additional rate of interest and penalties, and protect against a lot more aggressive collection actions by the IRS.

One usual reason is the idea that the taxpayer can pay the complete quantity either as a swelling amount or with a layaway plan. The internal revenue service also considers the taxpayer's revenue, expenses, possession equity, and future earning capacity. If these factors suggest that the taxpayer can pay for to pay more than the used amount, the internal revenue service is most likely to reject the deal.

Some Known Facts About Creating a Personalized Can You Remove Collections from Your Credit Report Without Paying? : APFSC Roadmap.

Dealing with Internal revenue service debt can be complicated and difficult. Tax specialists, such as Certified public accountants, tax obligation lawyers, or enrolled representatives, can supply indispensable help.

Table of Contents

Latest Posts

How The Benefits and Cons When Considering Debt Forgiveness can Save You Time, Stress, and Money.

Market Changes for Debt Forgiveness and Consumer Protections Can Be Fun For Anyone

Some Known Details About Ways to Begin with Your Debt Forgiveness Journey

More

Latest Posts

How The Benefits and Cons When Considering Debt Forgiveness can Save You Time, Stress, and Money.

Market Changes for Debt Forgiveness and Consumer Protections Can Be Fun For Anyone

Some Known Details About Ways to Begin with Your Debt Forgiveness Journey